The TaxInterest Family of Solutions

TaxInterest Gives You Interest and Penalty Expertise

When IRS interest and penalties cloud the waters, TaxInterest products give you the clarity to navigate. Whether you deal with IRS notices, FIN 48 reserves, or IRS net rate netting, there is a TaxInterest product to meet the challenge.

TAXINTEREST SOFTWARE LETS YOU ENSURE THE ACCURACY OF IRS INTEREST AND PENALTY CALCULATIONS

- TaxInterest software simplifies calculation of interest on both federal and state tax underpayments and overpayments

- User-friendly interface for tax and payment details

- Audit calculations and totals on transcripts and notices

- Calculate interest and penalties for amended returns, and late or non-filers

- Relied on by the IRS, CPA firms, and corporations since 1984

- Output reports are widely recognized by taxing authorities for accuracy and detail

TAXINTEREST FIN 48 EXCEL ADD-IN PUTS THE ACCURACY OF TAXINTEREST INTO YOUR SPREADSHEET

- Reduce calculation time per quarter from hours or days to only minutes

- Replace “hybrid” state interest calculations with specific state interest calculations

- Add functions to your existing spreadsheet or build one using our provided templates

- Be assured your calculations are current with automatically updated interest rates

- Reduce interest reporting steps during crucial quarter-end crunch time

- Eliminate transcription errors caused by transferring interest figures that were calculated outside your spreadsheet

More about TaxInterest FIN 48 Excel Add-In

TAXINTEREST NETTING FOR ACCURATE GLOBAL INTEREST NETTING CALCULATIONS

- Reliably determine the optimal global interest netting benefit per section 6621(d)

- User-friendly design for easy entry of IRS transcript and state tax detail

- Summary reports for multiple tax period calculations

- Flexible interface to facilitate easy “what-if” scenario development

- Produce Interest detail reports to show the specifics of each offset and equalization

- Standard and aggressive 6603 deposit calculation options

More about TaxInterest Netting software

THE TAXINTEREST SOFTWARE DEVELOPMENT KIT (SDK) GIVES YOU THE POWER OF TAXINTEREST IN YOUR APPLICATION DEVELOPMENT

- Accelerate your software development

- Can be used in virtually any Windows programming environment

- Available as a SOAP Web Service and ActiveX COM DLL

- Perfect for web-based or desktop applications

- Eliminate the time needed to research and develop in-house interest and penalty calculations

Highlights of TaxInterest

Built-in calculation methodology for all jurisdictions - federal, state, and international

Incorporate federal penalty calculations for nine common penalties

Interest calculations for all states with income taxes (46 states)

Ability to build your own custom interest rate tables

Interest rates are updated each quarter

Canadian federal (CRA), provincial, and territorial interest calculations

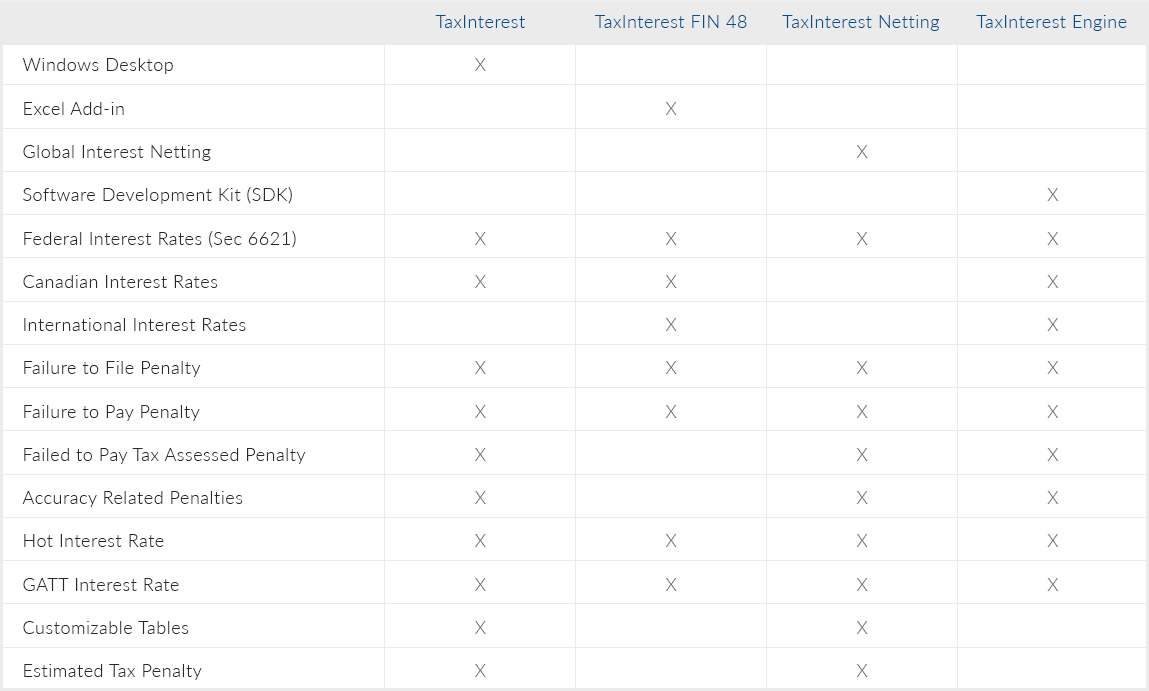

Which TaxInterest Is Right for You?

TaxInterest is the professional standard for calculating interest and penalties with unmatched accuracy. It is relied upon both by the IRS itself and accounting firms nationwide.

Watch a Short Video on the Capabilities of the TaxInterest Program

Join us for an upcoming complimentary webinar on “Mastering Interest and Penalty Calculations using TaxInterest Software".

Earn FREE NASBA Certified CPE Credit. Register now.

Frequently asked questions

Does TaxInterest do the interest calculations exactly like the IRS?

TaxInterest uses the same methodology as the IRS for the interest and penalty calculations.

How does the IRS make mistakes?

Calculations are based on amounts and dates. There can be wrong assumptions or incorrect inputs. Often, the IRS scans or inputs returns. There are also lots of toggles and overrides based on assumptions. The more manual touches, the more room for error. If there was an incorrect input amount or date, the interest and/or penalty calculation will be off. TaxInterest can reconcile these calculation differences.

Is there a benefit of using TaxInterest for an amended return, a non-filer, or late filer?

We all know the IRS is not known for their turn around. If you are sending in an amended return, a late return, or one for a non-filer and you pay both the tax and the interest and penalties, you are done. Otherwise, you will get another bill in a couple of months with more interest and penalties to deal with. This can get costly and create more work.

Will the TaxInterest FIN 48 Excel Add-in work with new versions of Excel and Office 365?

The add-in functions within all the latest editions of Microsoft Excel.

Not sure which TaxInterest Software solution is right for you?