Officer or shareholder loans are common for privately held businesses. These loans need to be monitored closely to determine whether they are truly loans, or compensation, dividends, or contributions to equity. For a loan to be genuine, both the lender and the borrower must intend that the debt be repaid. There are a couple general requirements that “a loan should be treated like a loan”. A shareholder cannot simply “say” something was a loan. They actually need to treat it as one and the borrower has to have the ability to repay the loan.

These are the key considerations:

Promissory Note - Perhaps the most persuasive position is whether you’ve executed a formal, written note that specifies all the repayment terms. Arm’s length loan contracts provide the interest rate, maturity date, collateral pledged to secure the loan, and a repayment schedule.

Payments - Another important piece of evidence you can provide when defending shareholder loans is proof that payments are actually being made.

Applicable Federal Rates - If your loans are more than $10,000 to a shareholder, you must charge what the IRS considers an “adequate” rate of interest. Specifically, the note should have a stated interest rate that follows (at a minimum) the published Applicable Federal Rates (AFRs). This provides strong evidence there is an actual arms-length transaction (an important general tax principle). The AFRs are published on TimeValue Software’s website at Applicable Federal Rates.

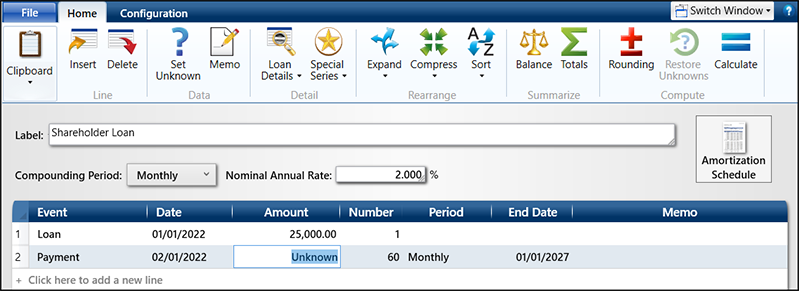

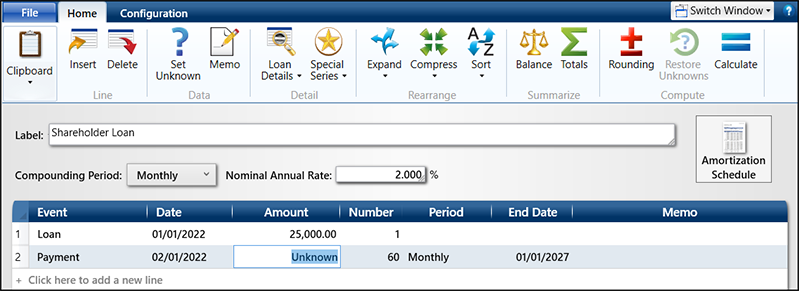

TValue software can structure the loan however you want and build your amortization schedules for documentation. In our example, we have a $25,000 loan for a shareholder with monthly payments for 5 years at 2%. The AFR at the initiation of the loan was 1.3% so we exceeded the minimum. We will solve for the payment amount, which will be $438.19.

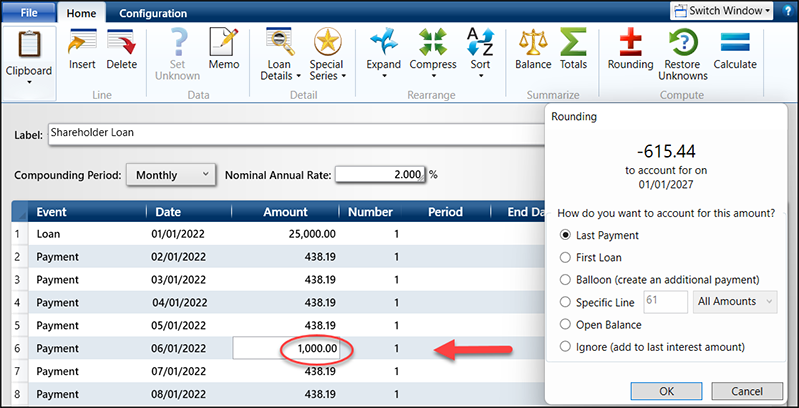

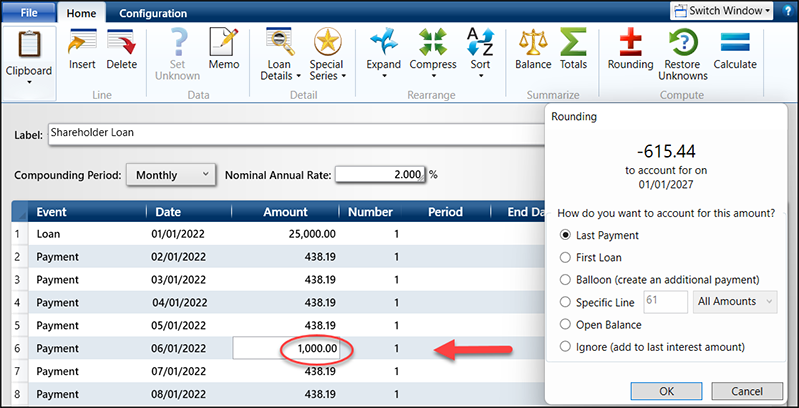

In TValue, you can track the loan, amend payments and dates, and re-amortize the loan with additional payments, missed payments, late payments, and keep a rolling balance of the outstanding loan. Below, we expanded the payments on the loan and input an additional payment amount. TValue will then automatically display options to re-amortize the loan.

After the additional payment amount, you will see the Rounding window indicating that the loan was over amortized; multiple options are offered to handle the difference including reducing the last payment. This documentation is critical to support the loan.

If you have any questions using TValue software, please give our Support Team a call at 800-426-4741 or shoot us an email at support@TimeValue.com.