Private party notes often use annual compounding, either at the end of the year or on the note's anniversary. In cases where regular payments are made, there's effectively no interest to compound at year-end. However, for scenarios with no payments or irregular payments, our customers often inquire about handling this in TValue. While TValue doesn't have a specific setting for annual compounding, there's a workaround available.

The workaround involves building a schedule for each year. Essentially, it entails calculating simple interest for the year, accumulating unpaid interest at year-end, adding it to the balance, and initiating a new schedule with the updated balance for the following year. In TValue, this requires creating a schedule per year, whether it's a year-end or anniversary schedule. The balance of principal and interest at year-end is carried forward to start the next year's schedule. Although it may require additional effort, it enables proper amortization of the note.

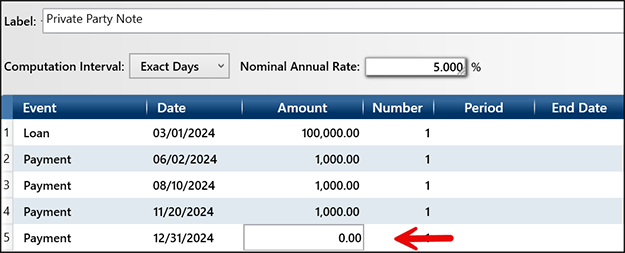

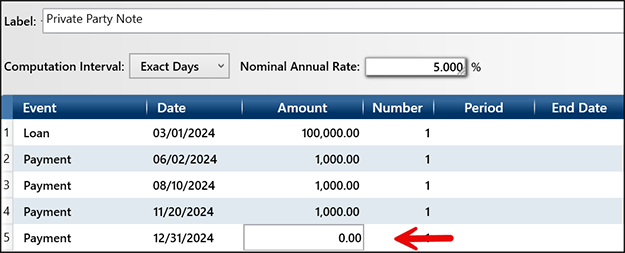

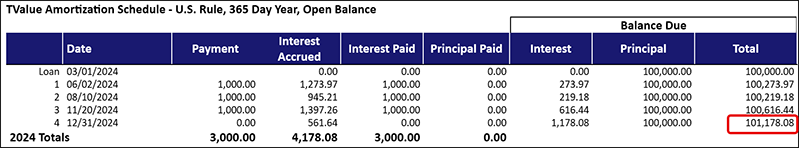

Let's illustrate this with an example: consider a $100,000 note initiated on March 1, 2024, with an interest rate of 5%. Initially, there will be random payments in the first year, followed by capitalizing the balance at the end of the calendar year for annual compounding. For this, the parameters of the schedule are U.S. Rule (simple interest) and Exact Days as the Computation Interval.

The crucial step in obtaining the year-end balance is to input a zero Payment on the year-end to accrue interest and generate the balance for the following year.

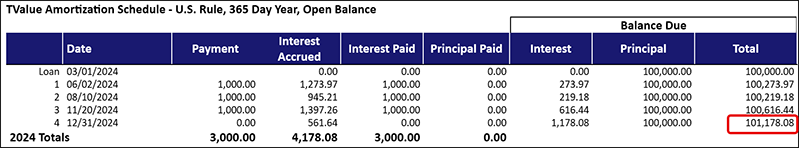

The resulting amortization schedule will show a balance of $101,178.08, which represents compounding the interest at year-end. This includes the principal and unpaid interest and is the basis for the next year's schedule.

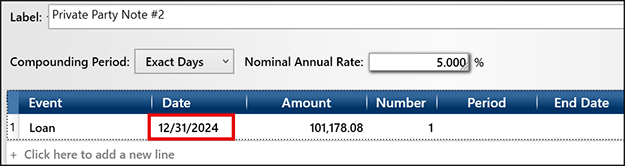

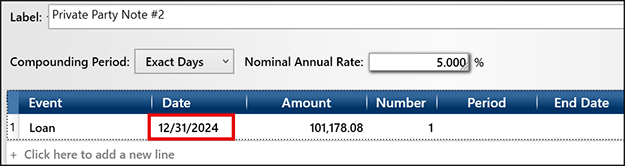

To start the next year's schedule accurately, begin with the balance from the prior year's schedule on the same date, 12/31/2024. This new schedule, applicable for the calendar year 2025, should also incorporate U.S. Rule with Exact Days for the computation.

It may take a little extra work but you can build your annual compounding schedules.

If you have any questions using TValue software, please give our Support Team a call at 800-426-4741 or shoot us an email at support@TimeValue.com.