People buy and sell notes all of the time. Sometimes they only want to buy or sell a partial of the note. We had a customer request assistance on purchasing a partial of a note utilizing TValue software.

Customer emailed us: “I'm working with a note seller to purchase a promissory note. The note was originally for $200,000 at 6%. Total months financed were 180 and the borrower has made 15 payments. The note seller would like an offer based on purchasing the next 60 payments. The remaining payments of 105 would revert to the note seller. I would like to get a 15% return on the purchase. How much should I pay?”

This is a two-step process in TValue. First, we structure the original note and determine the monthly cash flows. Then we create a separate schedule with the 60 cash flows with the specific dates and do a present value calculation to determine how much to pay for the note.

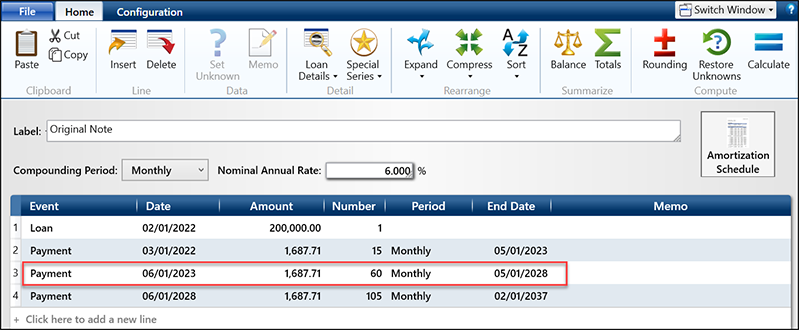

In TValue, we have a starting date of 2/01/22 for $200,000 and we build the schedule with 15 payments, 60 payments, and 105 payments to get the payment amount and the dates. You put “U” for unknown in the Amount field for each of the three payment groups and then click Calculate to determine the monthly amounts. You can see the highlighted 60 payments that will be the partial to be purchased in the image below.

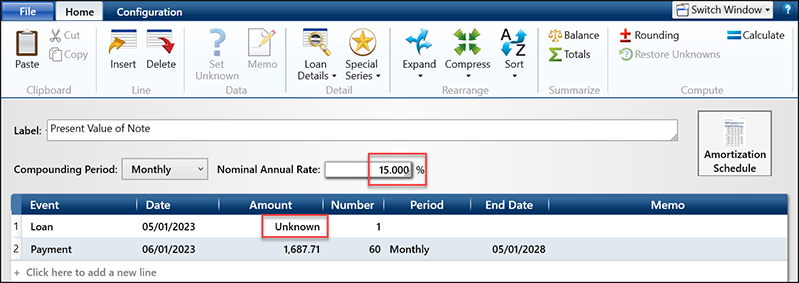

Now that we have the cashflows and the dates, we can do a present value calculation of the 60 payments to be purchased with a 15% return. To solve for the present value, you put “U” for Unknown for the Loan and then click Calculate.

For the purchaser to get a 15% return on purchasing the partial note, they need to pay $70,942.20.

If you have any questions using TValue software, please give our Support Team a call at 800-426-4741 or shoot us an email at support@TimeValue.com.