There is a federal mandate for a business to charge interest on loans to or from its owners or for other related party loans. Sec. 7872 was enacted as part of the Tax Act of 1984. This Code section required loans between certain related parties, usually in excess of $10,000, to bear a minimum amount of interest based on the applicable federal rates (AFRs). With short-term rates well under 1%, the resulting amounts of self-charged interest can seem negligible but should be done.

If you have an interest free loan and you want to determine the imputed interest on the loan, it is easy to do with TValue amortization software. With TValue, we will do a Present Value calculation to determine the interest using the AFRs.

First, you will need the AFRs based on the loan duration. The AFRs are either short-term (3 years or less), mid-term (more than 3 years and up to 9 years), or long-term (more than 9 years). Your loan must use at least the minimum rate. If we have a 10-year loan with annual payments, we would use the long-term AFR which for many years has been less than 1%. For our example we will use 1% for our Nominal Annual Rate.

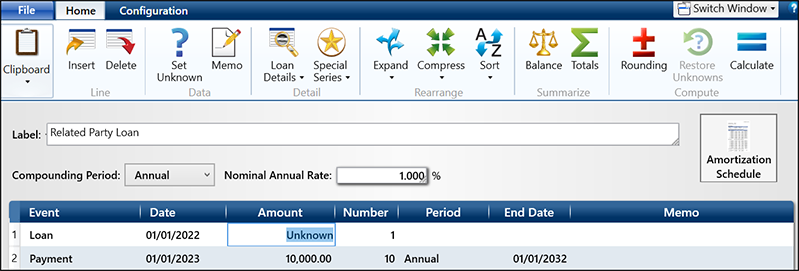

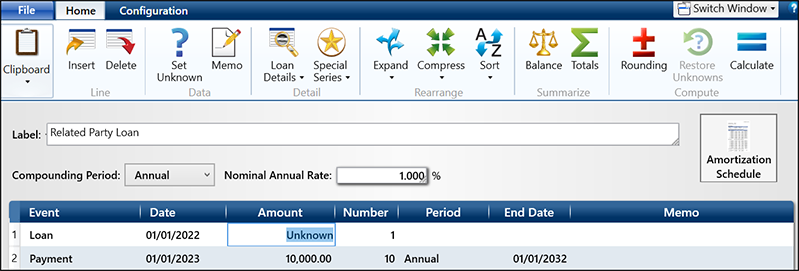

The next step is to input the cash flows. Let’s assume the original loan was for $100,000 with payments of $10,000 per year for 10 years. We will use Annual compounding. For the Loan Amount, we will put “U” for unknown and 1 for the Number since we are calculating a new loan basis. On line 2, we will input 10,000 for the Payment Amount and 10 for the Number.

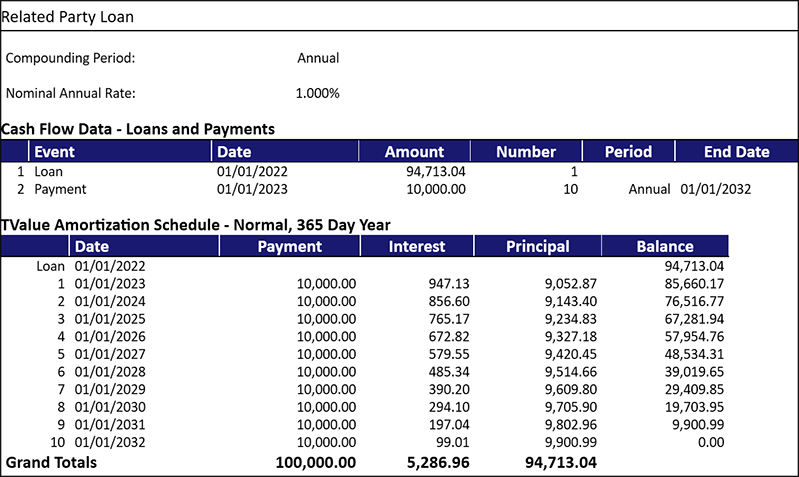

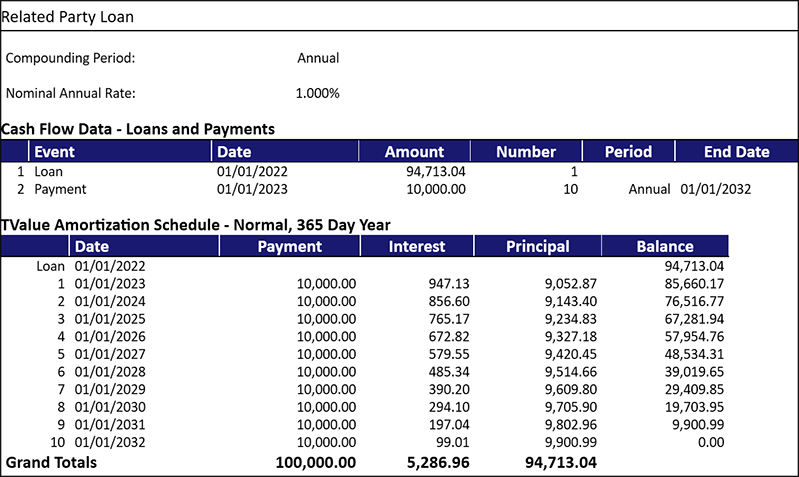

When you calculate the Present Value, the loan of $100,000 will become $94,713.04 and the difference will be the interest. This would be the interest each party would be responsible for. If you look at the amortization schedule, it will give you the interest detail based on the AFRs.

If you ever have a question on a TValue calculation or need any help, please feel free to give our Support Team a call at 800-426-4741 or email support@TimeValue.com