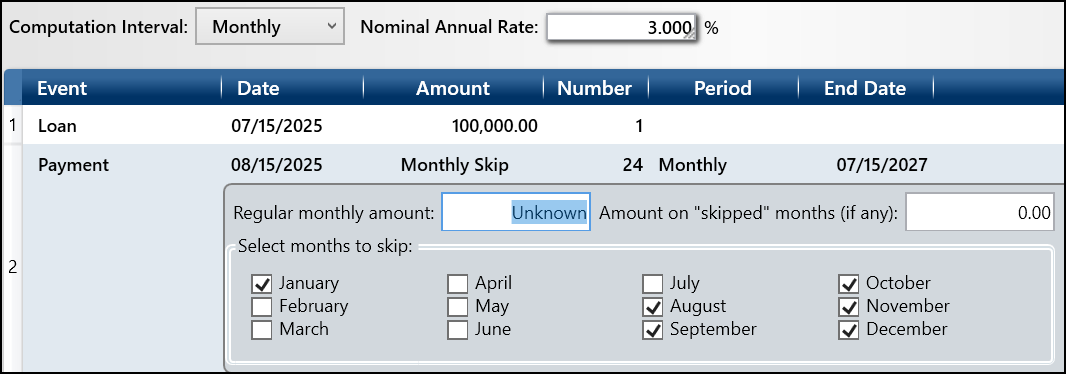

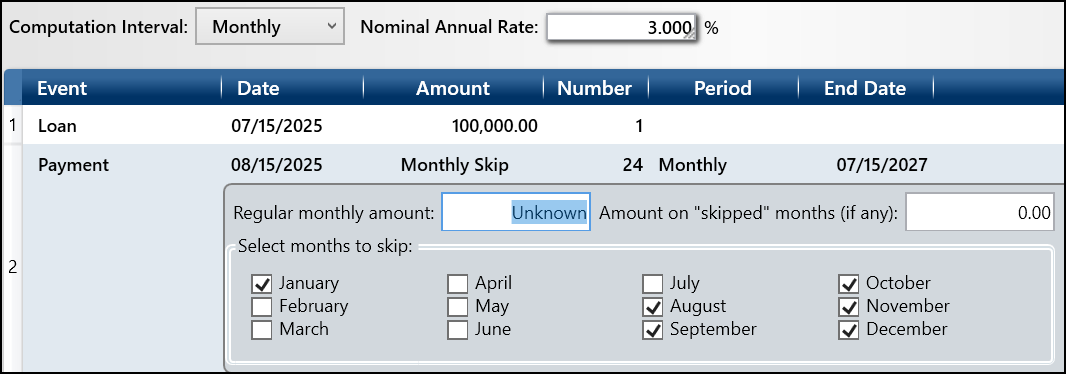

In cases where you have monthly skip payments, you may want a contact payment during the off months. This interim payment may be set to zero, but more commonly it's a minimum amount—frequently interest only. Although TValue doesn't have a built-in feature for calculating this configuration, there's a practical workaround.

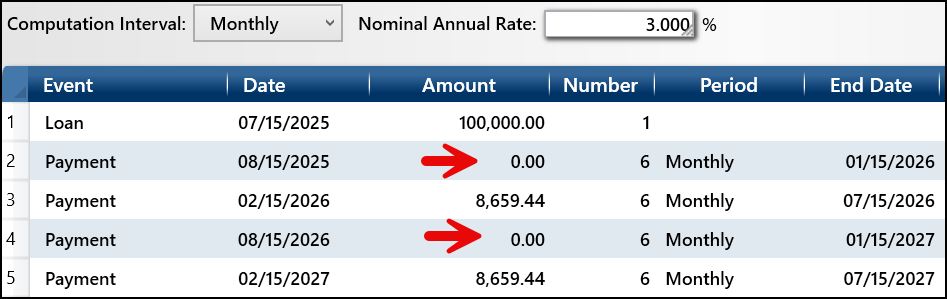

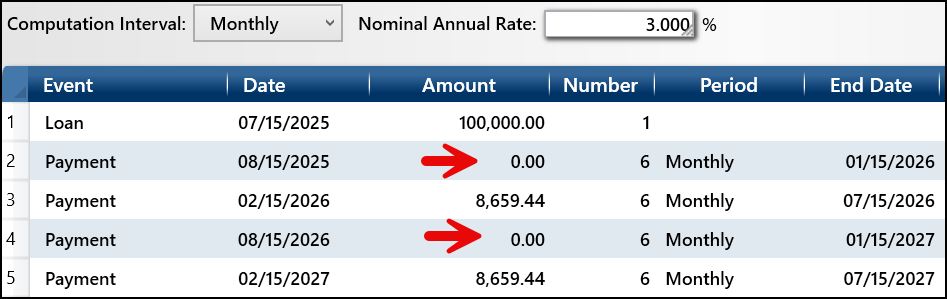

To implement it, set zero dollar payments for the months you wish to skip, then build and modify the loan accordingly. In the example below, the structure includes six months of interest only payments followed by six months of principal and interest over two years. This deal structure works especially well for seasonal loans by aligning payments/cash flows with the cyclical nature of the business's revenue.

Once you have set up the calculation, click Calculate, then Expand all lines, and then Compress all lines. This will give you the line items that you can modify to build your final schedule.

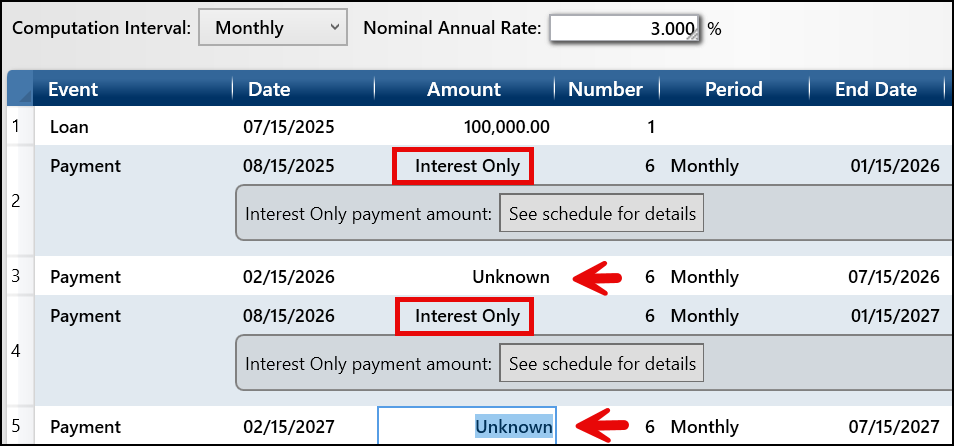

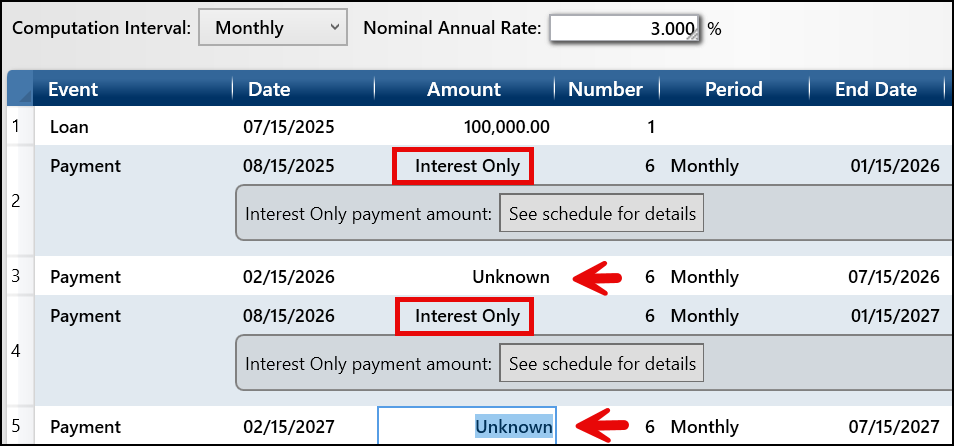

To do interest only payments for the zero dollar payments, you can change the two payment lines with a zero Amount to “interest only” using the Special Series feature. Then, change the two payments of 8,659.44 to “U” for unknown, click Calculate, click Amortization Schedule, and see your schedule with 6 months of interest only payments and 6 months of principal and interest payments for the 24 months.

Once modified, this model will give you principal and interest payments of 8,469.37 for the 12 months and TValue will calculate the interest only payments each month as the loan is paid down.

Building interest only payments into a monthly skip model is very doable in TValue, it just takes a couple of extra steps, but it is relatively quick to set up.

If you have any questions using TValue software, please give our Support Team a call at 800-426-4741 or shoot us an email at support@TimeValue.com.