The XIRR (Extended Internal Rate of Return) return on investment function is a complicated calculation, but with TValue, it is surprisingly simple to do. XIRR is a more flexible version of IRR (internal rate of return) that calculates the annualized rate of return for a series of cash flows occurring at irregular intervals.

Where IRR generally assumes evenly spaced periods (monthly, annually, etc.), XIRR allows you to specify the exact date of each cash flow. This is ideal for projects or investments with inconsistent cash flows.

With TValue, you simply enter the cash flow amount and its corresponding date. From there, the software can solve either the annualized rate of return or the future value, depending on your needs.

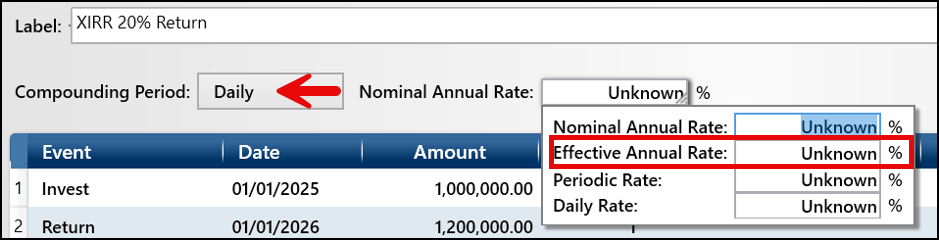

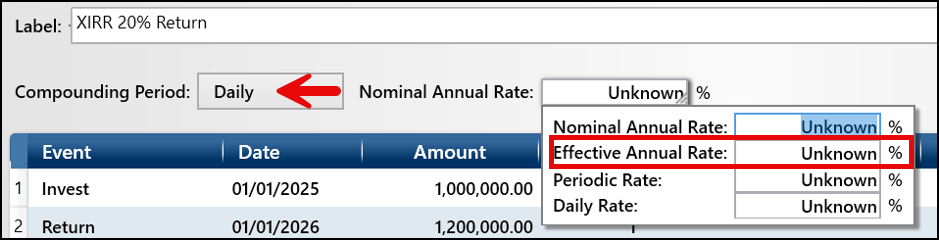

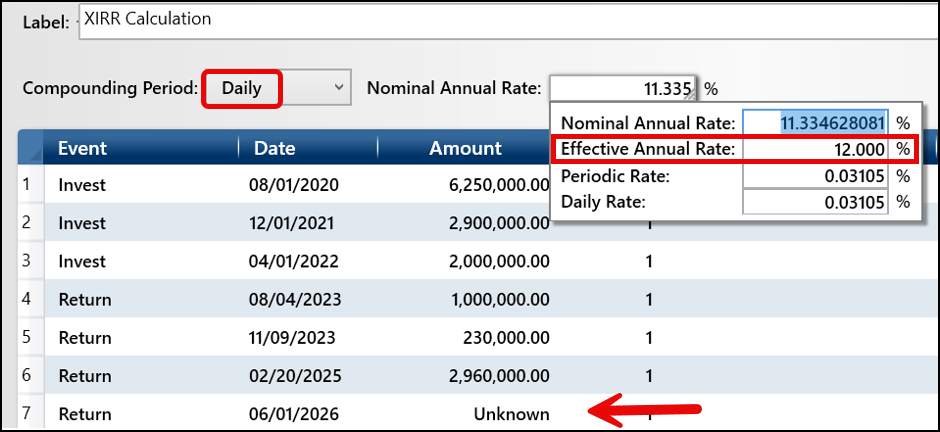

The key to doing the calculation in TValue is the set up. Set the Compounding Period to Daily. Then, use the Effective Annual Rate for the interest rate / return.

Let’s say you invest $1,000,000 and receive $1,200,000 exactly one year later. That’s clearly a 20% return. Let’s do a quick calculation in TValue. Set the Compounding Period to Daily, open the interest rate dialog and enter “U” for Unknown for the Effective Annual Rate, and then click Calculate.

The Nominal Annual Rate will show 18.237% but the Effective Annual Rate will be 20.000%.

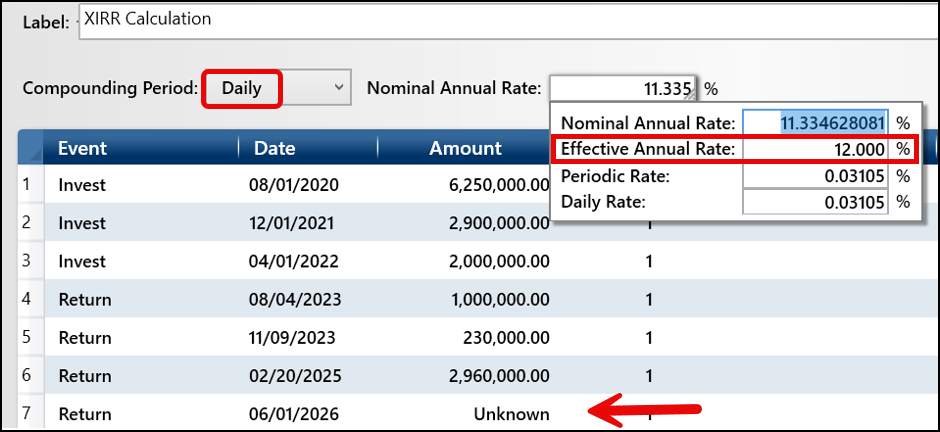

Let’s do another example and solve for a future value with an Effective Annual Rate of return of 12%. In this example, we have three investments over two years and then we start getting our returns over the next three years with the final amount subject to the 12% return. The Compounding Period is Daily, the Effective Annual Rate is 12%, and input “U” for Unknown to solve the projected return on the last line item, future value.

The Unknown / Return is 15,040,903.91.

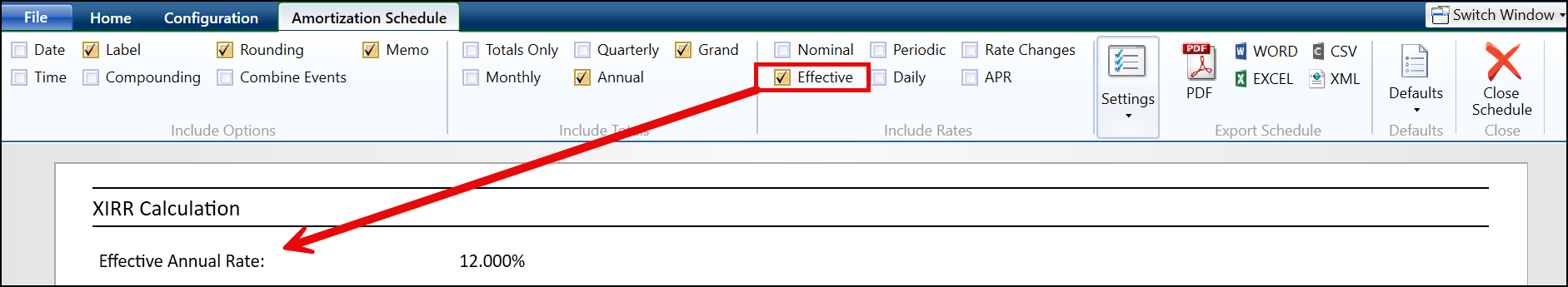

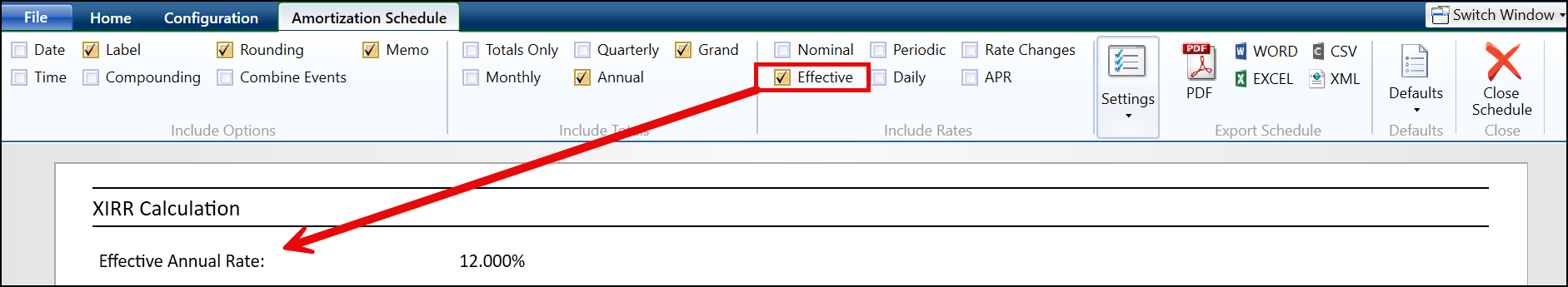

For presentation purposes, you always want to change the Nominal Annual Rate to the Effective Annual Rate on the Amortization Schedule. This is easy to do by checking Effective and unchecking Nominal in the Include Rates section on the Amortization Schedule’s ribbon.

As you can see, solving the internal rate of return or the XIRR calculation is easy to do in TValue.

If you have any questions using TValue software, please give our Support Team a call at 800-426-4741 or shoot us an email at support@TimeValue.com.