An annuity is an investment that provides a series of payments in exchange for an initial lump-sum payment. If you want to evaluate an annuity, you can start with how much you want to invest or you can start with how much you want in future payments to find out how much to invest today. The other factors to consider are how often the withdrawals occur and what would be your average annual return.

With this information you can do “what if” calculations to find the right combination of investment and return that will work for you. TValue software is an excellent tool to do these “what ifs”. For this exercise, we are going to look at a deferred annuity with a onetime payment. We will do two example cases: one determining a term and the other determining an investment.

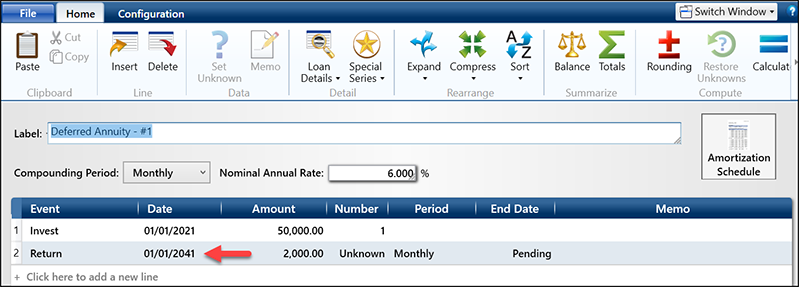

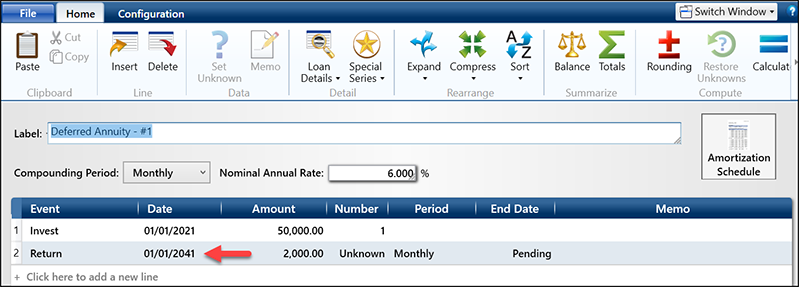

Case 1. Let’s assume you have $50,000 that you want to invest in an annuity. You expect it to have a 6% return and you want payments beginning in 20 years at $2,000 per month. How long will the payments last?

Using TValue, we can set the Compounding Period to Monthly. The Nominal Annual Rate at 6%. On line 1, enter an Invest Event with a Date of 01/01/21 and an Amount of 50,000. On line 2, enter a Return Event with a Date of 01/01/41 and an Amount of 2,000. Enter “U” for unknown for the Number. (See the image below.) Click Calculate and you will get a term/Number of 106 months plus a small residual.

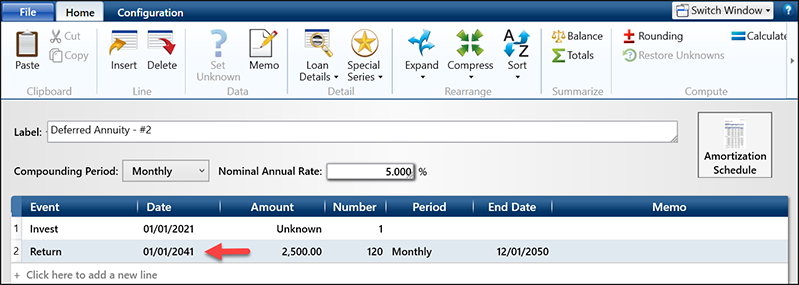

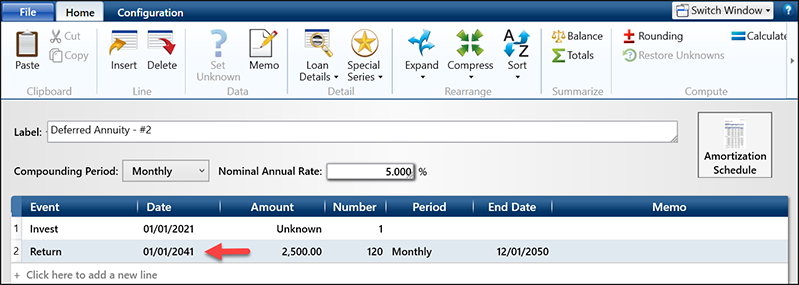

Case 2. Let’s assume you want to invest in an annuity, and you would like withdrawals of $2,500 per month, for 10 years, starting 20 years from now, at an average annual rate of 5%. What would the investment amount need to be?

In TValue, choose Monthly compounding with a Nominal Annual Rate of 5%. On line 1, enter an Invest Event with a Date of 01/01/21 and an Amount of “U” for unknown. On line 2, enter a Return Event with a Date of 01/01/41, an Amount of 2,500, and 120 for the Number. (See the image below.) Click Calculate and you will get an investment Amount of $87,252.81.

If you have three of the four variables between the investment, the return, the term, and the withdrawal amount, you can solve for the fourth variable. TValue is an excellent tool to do the “what ifs” to find the right situation for you.

If you have any questions or need any help using TValue software, please give our Support Team a call at 800-426-4741 or email support@TimeValue.com.