One of our customers made this comment “How can I create a cash basis amortization schedule on an EIDL? Firm received EIDL loan and did not make payments for the past year. Under cash basis rules, I believe 100% of the first payments will be interest until the back interest is paid. Thank you, you'll have a lot of EIDL questions in the future. Consider making a blog post guide on how to run the calcs.”

We are glad to discuss how to handle this topic. These loans provide economic relief to small businesses and nonprofit organizations that are currently experiencing a temporary loss of revenue. The terms may vary and can be up to 30 years. Many of these loans have no payments for the first year. The question is how do you set it up in TValue.

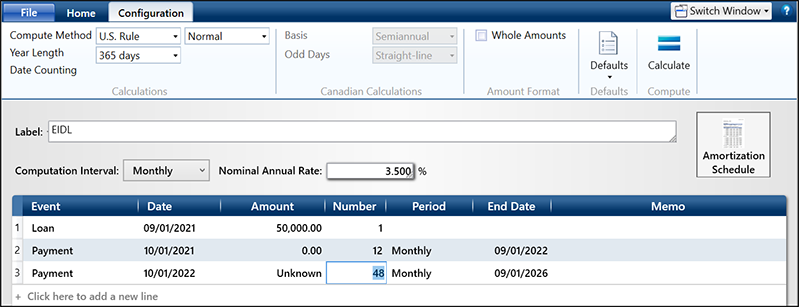

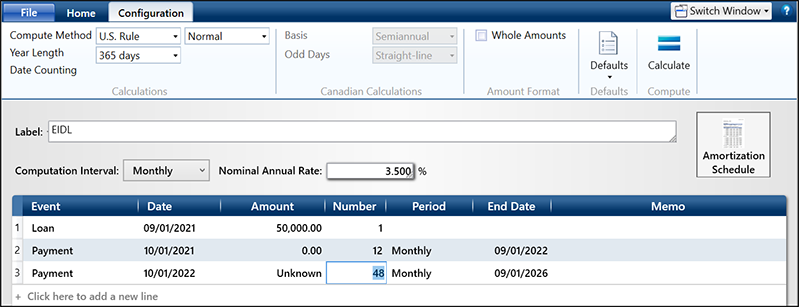

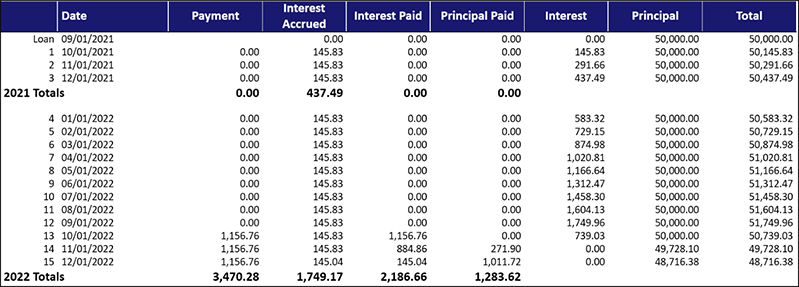

They key to setting up the loan is to set the Compute Method to U.S. Rule, simple interest. Simple interest allows TValue to accrue the interest and then to pay the accrued interest first, and to show the amount of interest paid with each payment. You have two options to handle the first year. If you want to see the monthly accrual (graphic below), you can make 12 payments for $0.00 and then start the repayment of the loan and solve for an unknown payment amount, beginning with the 13th payment/month.

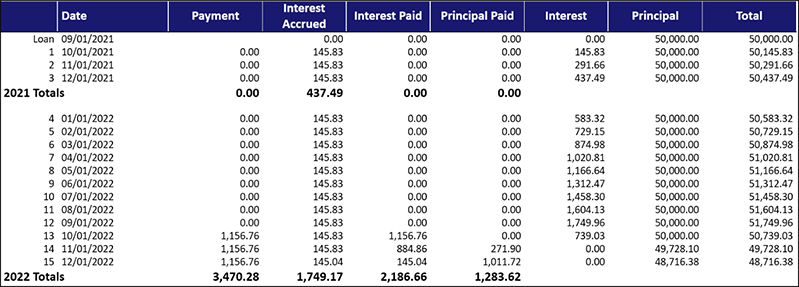

The TValue amortization schedule will show the Interest Accrued on a monthly basis and post the amount to Interest in the Balance Due column. The first payment will be applied towards the interest first and once the interest is paid, the payments will be allocated to principal and interest. The Interest Paid column will be your cash basis entry.

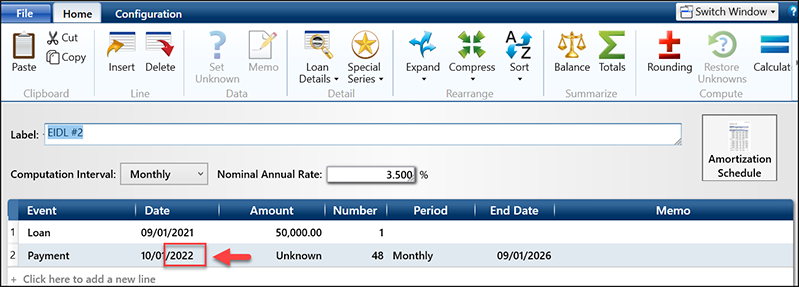

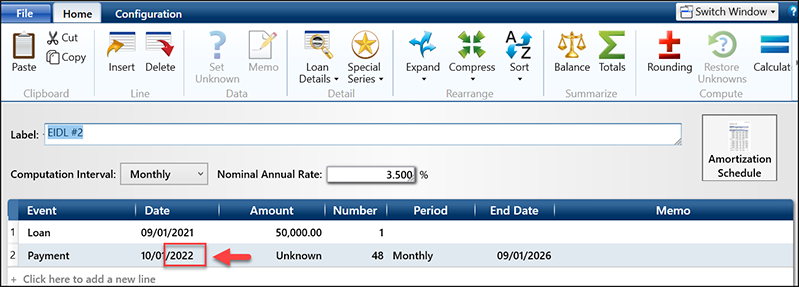

Another option is to just make the first Payment one year later and solve for that series of payments over the remaining term (graphic below). Even though there is not an event, TValue will accrue the interest for the 12 months, the first payment will pay interest, and then payments will be allocated between principal and interest. The results in the cash flows will be exactly the same.

If you ever have a question on a TValue calculation or need any help, please feel free to give our Support Team a call at 800-426-4741 or email support@TimeValue.com.