The Failure to Pay penalties are interest bearing from the notice (or assessment) dates both for the Failure to Pay Tax Shown on Return §6651(a)(2) and the Failure to Pay Amount Assessed §6651(a)(3). TaxInterest software will calculate the interest but only if you complete the inputs for the late payment notices.

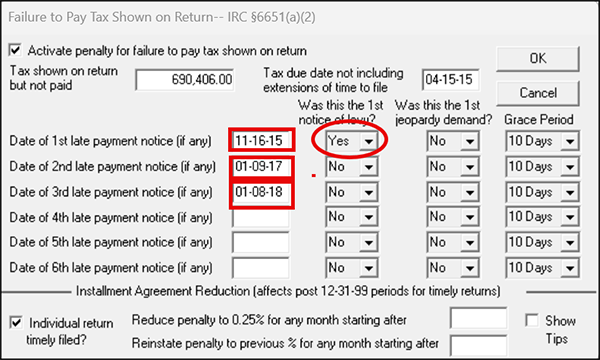

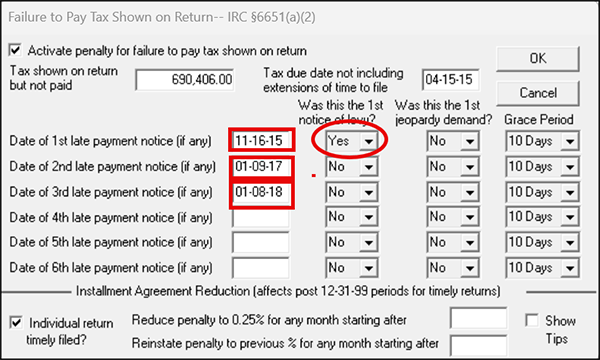

On the Failure to Pay Tax Shown on Return dialog, input the late payment notice dates. From the Transcript, these dates would be when the IRS charged the Failure to Pay penalty or Code 276, Penalty for late payment of tax. Be aware that there can be multiple notice dates. These notice dates trigger charging interest on the penalty balance at that point in time, and the second notice date calculates the additional penalty balance and the interest on the total penalty accumulated. The red boxes are where you input the notice dates.

A few other items of note for the Failure to Pay penalty:

- If the IRS issues an intent to levy notice or a jeopardy demand notice and the taxpayer doesn’t respond, the Failure to Pay penalty will increase from 0.5% to 1.0% from the Notice Issued date from the Transcript. Click Yes on the notice date to activate the 1.0%.

- On the bottom of this dialog, you can click on “Individual return timely filed?” which will activate the Installment Agreement Reduction. There, you can input the date that the installment agreement starts and if it stops. This will reduce the Failure to Pay from 0.5% to 0.25%.

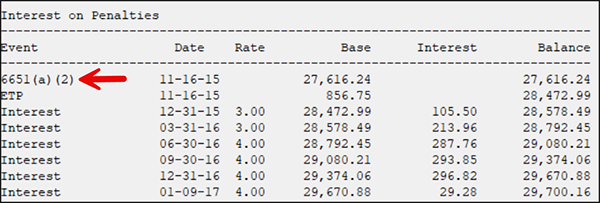

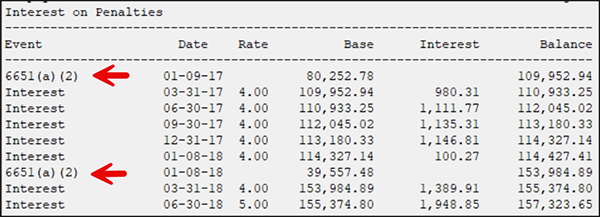

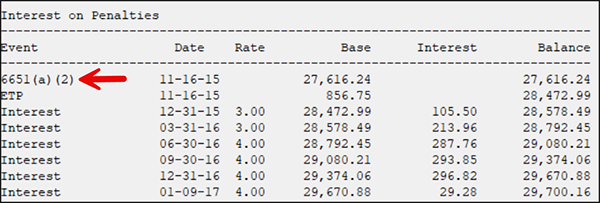

The interest begins accruing from the notice dates. On this report, the penalty for the Failure to Pay Tax Shown on Return is as of the 11-16-15 notice date and interest will start accruing.

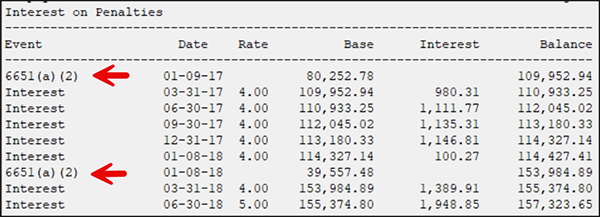

On the second and third notices, the additional penalty amount is added to the base and the interest is calculated on the new balance going forward.

The Failure to Pay Amount Assessed works exactly the same but the first line is the “Date of notice to pay tax”. This is when the penalty starts calculating. The first notice date is when the interest starts accruing. One other note: when you have both Failure to Pay penalties, you need to adjust the amount of each penalty to match the specific amounts, and the total of the two should agree with the Tax amount on your main dialog.

If you have any questions using TaxInterest software, please give our Support Team a call at 800-426-4741 or email us at support@TimeValue.com.