In 1984, the Tax Reform Act set provisions for applicable federal rates (AFRs). This is a minimum tax rate that must be charged on all loans, including personal/family loans. The IRS provides various prescribed rates for federal income tax purposes each month and TimeValue Software offers them on our website at Applicable Federal Rates | TimeValue Software.

The most common usage of the AFRs is to compute imputed interest. The IRS “imputes” or determines for the lender the interest income they would have received subject to the AFR rates if they extended a below-market loan which often is interest free. Lenders must determine the "imputed interest" for tax purposes as taxable income.

What interest rate do you use? There are various AFR interest rates and they differ slightly based on the term of the loan (short-term, mid-term, and long-term) and the compounding periods (e.g., monthly, quarterly, semiannual, or annual). Short-term is defined as 3 years or less, mid-term is more than 3 years and up to 9 years, and long-term is more than 9 years.

Note, the tax code exempts gift loans of under $10,000 from the imputed interest rule. The same threshold of $10,000 goes for employment-related loans and those made to shareholders.

Let’s look at an example. You lend your son or daughter $60,000 for 10 years, interest free to buy their first house. With this agreement, the payments would be $500 per month. You didn’t charge interest but you need to record interest income subject to the AFRs.

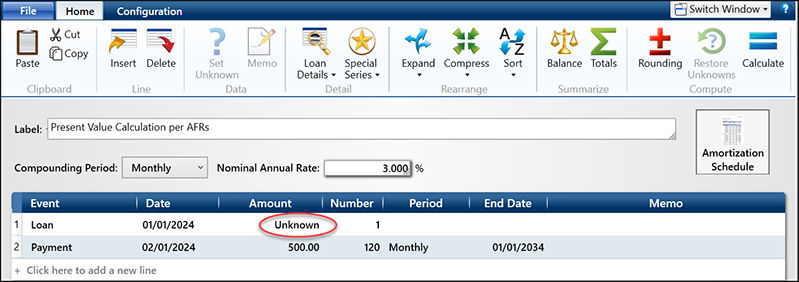

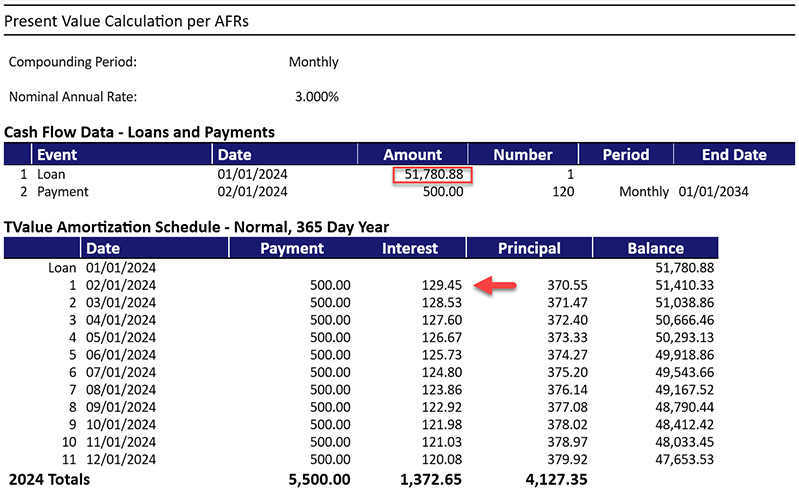

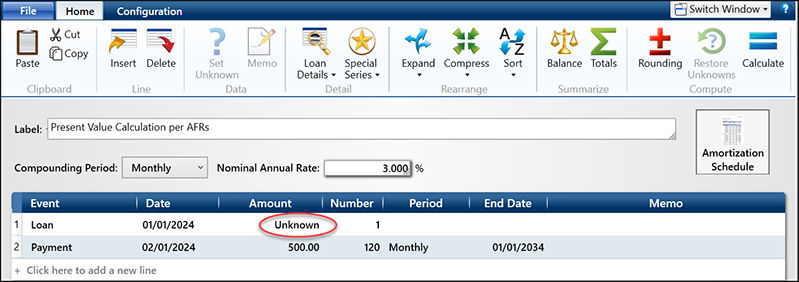

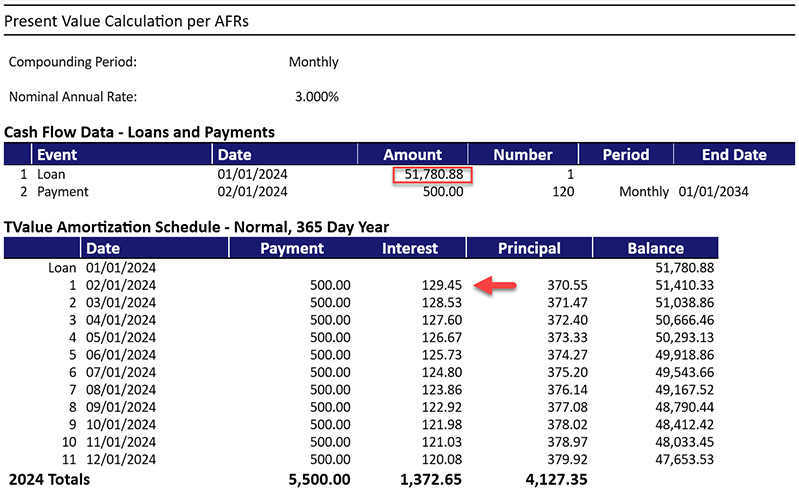

Let’s assume the long-term AFRs for Monthly payments is 3%. You need to do a present value calculation using the $500 monthly cash flows and discount it at 3%. Here are the inputs into TValue.

Using a program such as TValue makes this quick and easy to do. Under these assumptions, the present value is $51,780.88 so your first payment would include $129.45 of interest. The amortization schedule would give you your interest income for the year.

The interest rate that is used is the rate applicable at the time of the loan and is generally fixed for the duration.

If you have any questions using TValue software, please give our Support Team a call at 800-426-4741 or shoot us an email at support@TimeValue.com.