Original Issue Discount refers to the excess of an obligation’s stated redemption price at maturity over its issue price, and it is taxable as interest over the life of the obligation on a year-by-year basis. It is effectively interest income. Those debt instruments that may have OID include zero coupon bonds, debentures, notes, certificates, or other evidence of indebtedness having a term of more than one year.

The adjusted issue price of a debt instrument at the beginning of an accrual period is used to figure the OID allocable to that period. In general, the adjusted issue price at the beginning of the debt instrument's first accrual period is its issue price. The yield-to-maturity (YTM) is the discount rate that, when used in figuring the present value of all principal and interest payments, produces an amount equal to the issue price of the debt instrument. This is the variable we will solve to determine the interest income.

In our example, we bought a bond at original issue for $95,000 on January 1st, 2022. The 10-year debt instrument matures on January 1st, 2032, at a stated redemption price of $100,000. The bond’s coupon provides for semiannual payments of interest at 10%. The bond has $5,000 of OID ($100,000 stated redemption price at maturity minus $95,000 issue price) plus the interest income.

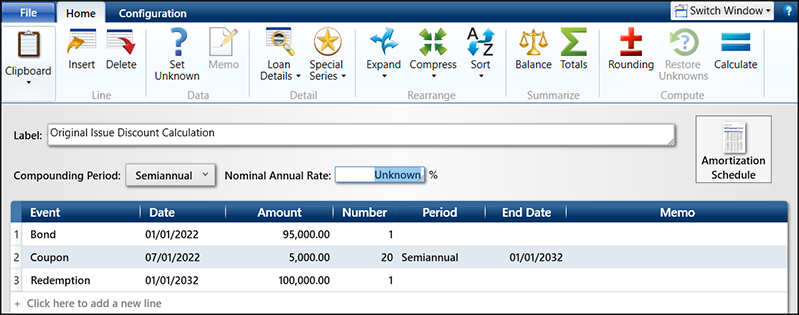

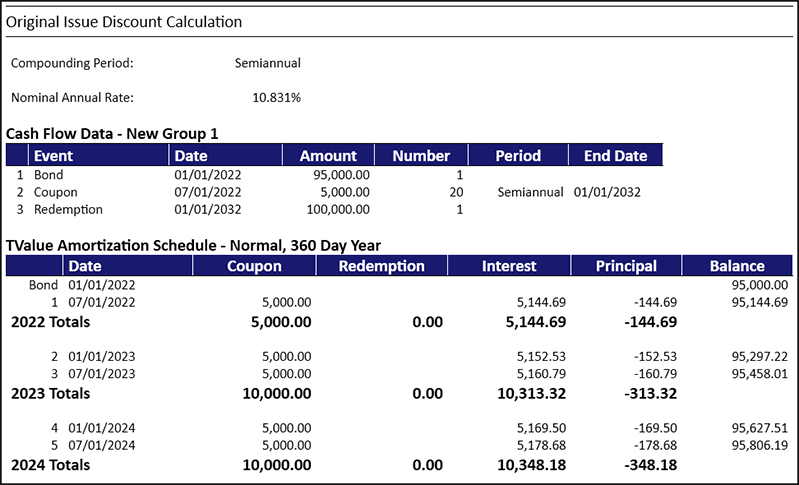

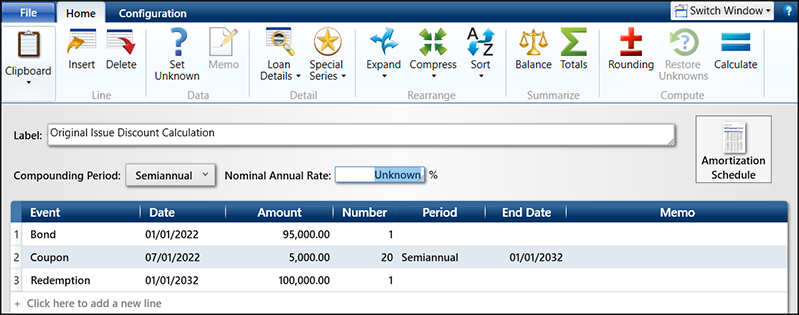

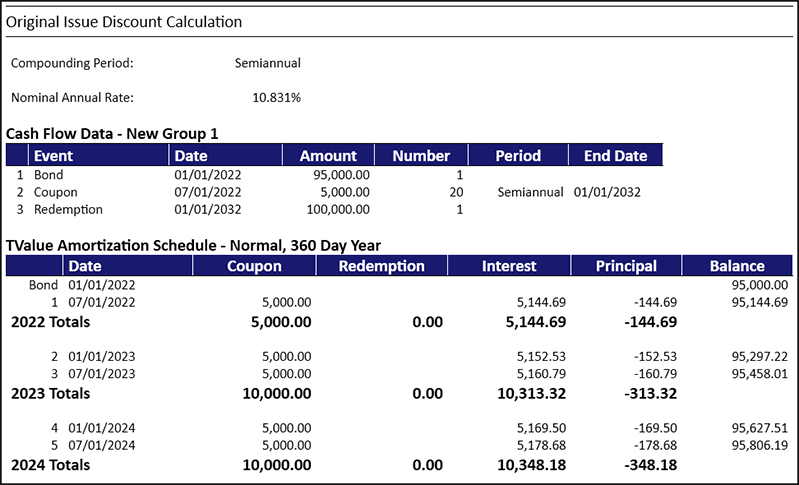

In TValue, you would set the Compounding Period to Semiannual and input “U” for the Nominal Annual Rate. Then input the Bond on 1/01/22 for 95,000, semiannual payments of 5,000 (10% of the 100,000 face value, semiannually) and the Redemption of the Bond for 100,000. Then Calculate and solve for interest rate or the yield-to-maturity.

The amortization schedule gives you the interest income which includes the coupon interest and the amortization of the OID for tax purposes.

There are multiple scenarios on different situations to handle Original Issue Discounts that may have a different twist, but each variation can be handled by TValue software. If you have any questions using TValue software, please give our Support Team a call at 800-426-4741 or shoot us an email at support@TimeValue.com.