The present value and the net present value are essentially the same calculation. As the example below shows, the difference has to do with whether there is a starting balance or not.

What is the difference between Present Value (PV) and Net Present Value (NPV)?

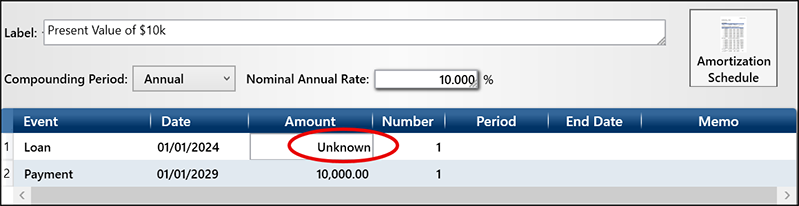

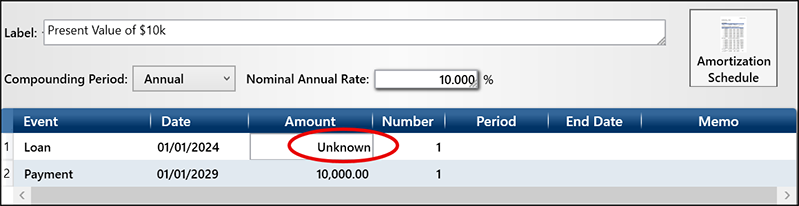

Present value is the result of discounting future cash flows to the present. For example, a cash amount of $10,000 received at the end of 5 years will have a present value of $6,209 if discounted at 10% compounded annually.

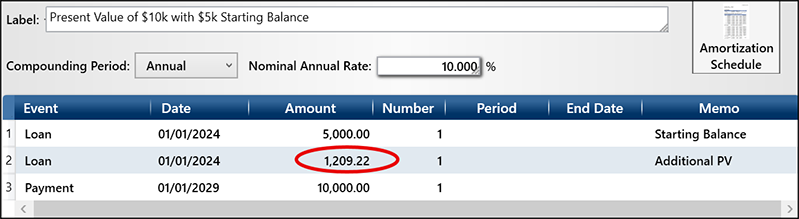

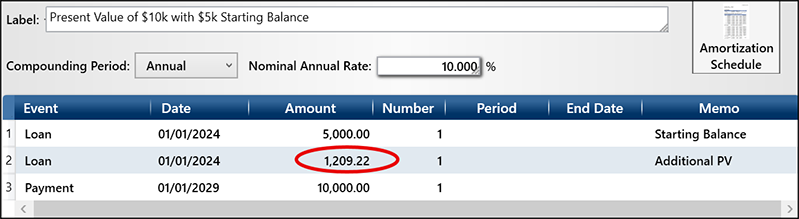

Net present value is the present value of the cash inflows minus the present value of the cash outflows. For example, let's assume that an investment of $5,000 today will result in one cash receipt of $10,000 at the end of 5 years. If the investor requires a 10% annual return compounded annually, the net present value of the investment is $1,209. This is the result of the present value of the cash inflow $6,209 (from above) minus the present value of the $5,000 cash outflow. (Since the $5,000 cash outflow occurred at the present time, its present value is $5,000.)

In TValue, this is very easy to do. For the PV calculation in our example above, you want to set the Compounding Period to Annual, set the discount rate / Nominal Annual Rate to 10%, go to line 1 and create a Loan with “U” (for Unknown) in the Amount field, go to line 2 and create a Payment with a Date 5 years after the Date in line 1 and with an Amount of $10,000, and then choose Calculate to solve for the PV of $6,209. The PV is always the Amount on line 1.

For the NPV, you have a starting balance. In TValue, set the Loan Amount on line 1 to $5,000, go to line 2 and create another Loan Event with the same Date as line 1 and with “U” for the Amount, and then go to line 3 and create a Payment with a Date 5 years after the Date in lines 1 and 2, and with an Amount of $10,000.

When you choose Calculate to solve for the Amount on line 2 and then add it to your beginning Amount on line 1, you have the “net” present value. The net amount ($6,209) is the same in either calculation.

From our experience in the calculation world, present value and net present value are used interchangeably and few people understand the difference but there is one.

If you have any questions using TValue software, please give our Support Team a call at 800-426-4741 or email us at support@TimeValue.com.