Reconciling IRS transcripts can range from a quick and straightforward task to a complex puzzle requiring careful attention to details. Fortunately, TaxInterest simplifies this process, making it easier for tax professionals to analyze and verify financial records. In fact, approximately 40% of our customers rely on TaxInterest to handle transcript reconciliation efficiently.

When working with IRS transcripts, the complexity often depends on the length of the document. If a transcript is just one or two pages, the reconciliation process is usually straightforward. However, when dealing with three or four pages, things can get tricky. Multiple penalty assessments, debits and credits from prior years, and jeopardy notices can complicate the calculations, requiring a structured approach.

The key to ensuring accurate reconciliation—and identifying errors—is to categorize each financial component. Breaking down the transcript into distinct sections such as net tax due, subsequent payments and credits, individual penalties, and interest calculations allows for a clear and organized review. This method enhances accuracy and helps pinpoint discrepancies efficiently.

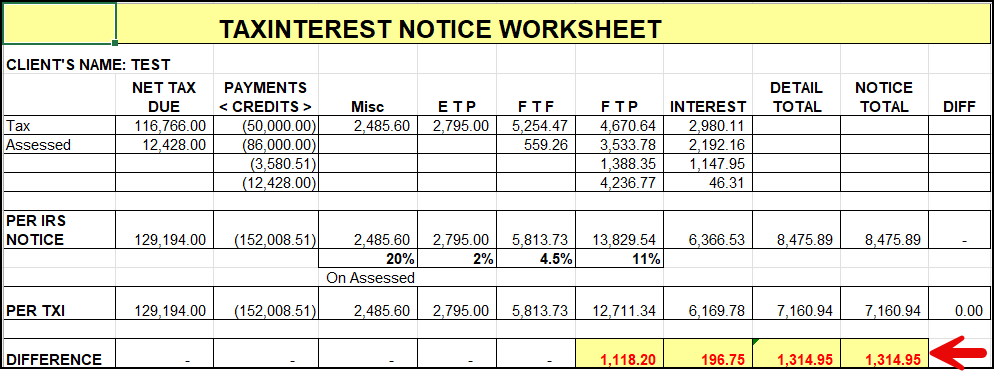

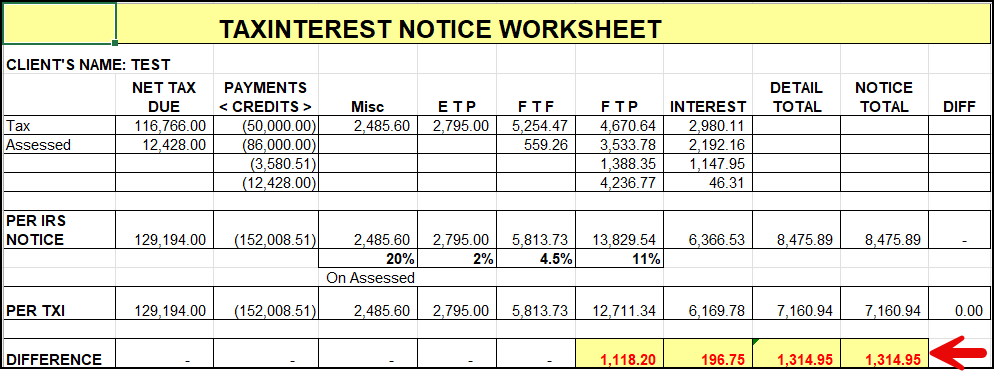

We have an Excel worksheet that we use internally when customers call us for help. This worksheet is easy to input and puts everything in buckets to quickly analyze.

We can take this information and then put it into TaxInterest and easily see our differences. In this situation, the Assessed amount was actually charged from the tax due date versus the assessment date. The IRS overcharged by $1,118.20 plus the related interest so it was actually pretty easy to find out. This was a live case that we helped the customer with reconciling.

By leveraging TaxInterest, professionals can reduce the time and effort needed for transcript reconciliation, ensuring reliable results and minimizing potential errors.

Whether dealing with a simple or complex case, having the right tools can make all the difference.

If you have any questions about TaxInterest software, please give our Support Team a call at 800-426-4741 or shoot us an email at support@TimeValue.com.