The key to tracking a Line of Credit (LOC) in TValue software lies in the settings. LOCs are financial products that provide borrowers with access to a predetermined amount of funds, similar to a revolving credit facility.

Borrowers can access funds from the LOC up to the credit limit at their discretion. Payments on a line of credit are typically due monthly, although the exact payment schedule may vary depending on the terms of the agreement. Payments may consist of both principal and interest, or they may be interest only during a specified period, with the option to pay down the principal as desired.

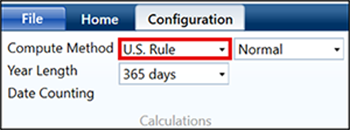

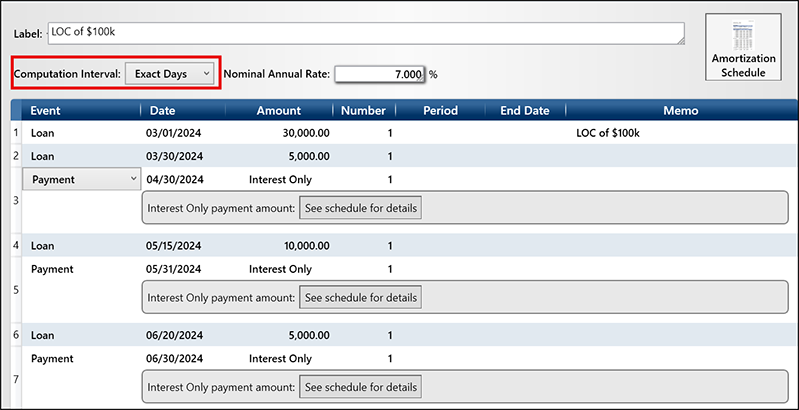

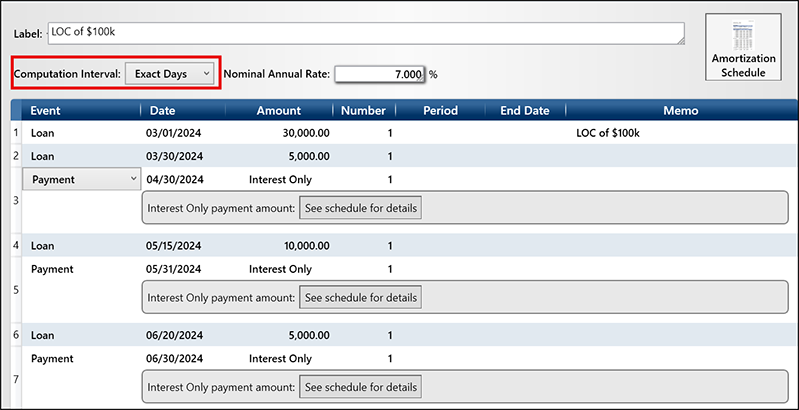

In TValue 6, LOCs can be structured as follows. Let’s assume we have a $100,000 LOC, we are going to start drawing on it, and follow by making monthly interest only payments. Generally, you want the Compute Method to be U.S Rule (simple interest).

Your Computation Interval will be Exact Days. Exact Days counts the days between events to calculate the interest. Here, you can see the various loan amounts as they draw on the LOC and the payments are interest only in the beginning of this loan.

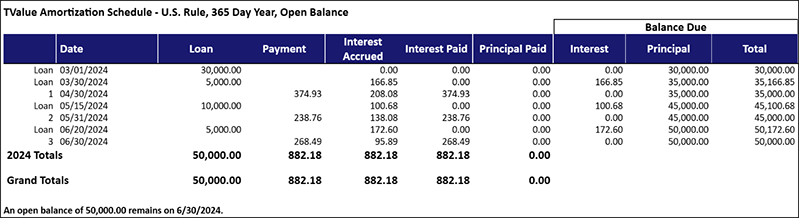

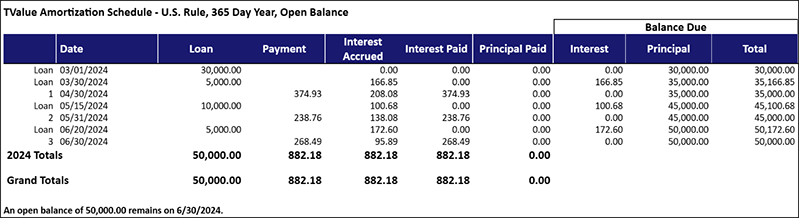

From the amortization schedule below, you can see the interest accruing at each event and any unpaid interest will accrue in the Balance Due column for Interest. Then the interest only payment at the end of each month will capture the Interest Accrued and any interest from the Balance Due, Interest.

If you have principal only payments during the term, you can setup a payment by clicking on Special Series from the ribbon and then click on Principal First and input the principal payment. TValue will apply the payment to the principal balance and accrue the related interest accordingly.

If you make a normal payment, TValue will always allocate funds to pay interest first and then principal. If you want to pay off the loan with fully amortized payments in the future, you can create a Payment as the last Event, enter 'U' for Unknown in the Amount field, specify the term for the Number, and then click Calculate to determine your payments.

If you have any questions using TValue software, please give our Support Team a call at 800-426-4741 or shoot us an email at support@TimeValue.com.