With interest rates increasing over the last couple of years, sometimes buying the rate down can be a great strategy. A buydown is a way for a lessee to obtain a lower interest rate and payments by having points paid up front at closing. Seller-paid buydowns are the most common type of lease buydown.

To structure a lease interest rate buydown, you will need to:

- Determine the desired interest rate reduction. This will depend on your budget and the current market interest rates.

- Calculate the cost of the buydown. The cost of a buydown is typically between 0.5% and 3.0% of the lease amount.

- Decide who will pay for the buydown. The buydown is generally paid for by the seller but could be by the buyer or a combination of both.

- Draft a buydown agreement. This agreement should outline the terms of the buydown, including the amount of the buydown, the duration of the buydown, and who is responsible for paying for the buydown.

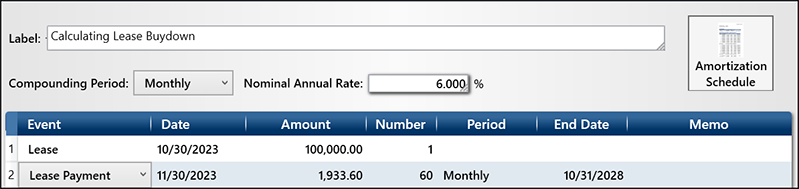

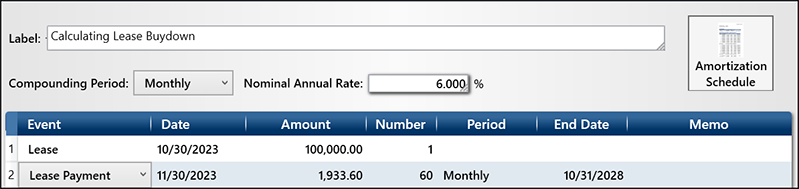

Here is an example of a lease interest rate buydown structure:

- Lease amount: $100,000 for 5 years

- Desired interest rate reduction: 1%

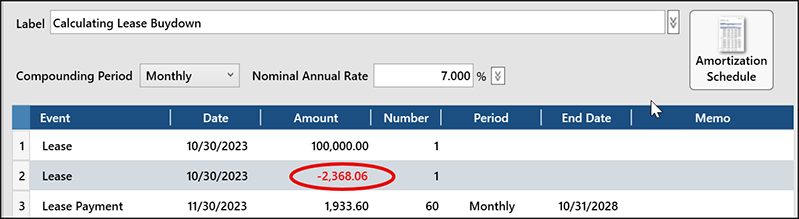

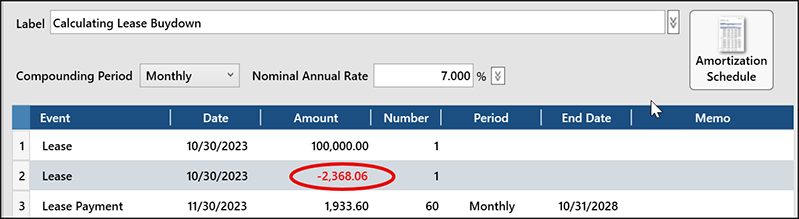

- Cost of buydown: $2,386 (about 2.4% of $100,000)

In this example, the seller would pay $2,368 upfront to reduce the interest rate by 1%. This would reduce the lessee's monthly lease payment to $1,933.60.

TValue software is an excellent program to structure a buydown and do the “what if” calculations to determine the best deal for both parties. With TValue, you can structure the payment at the buydown rate and then change the rate to the market rate and solve for the buydown amount.

In TValue, this is a two-step process. First, we want to solve for the Payment with the buydown rate, e.g., 6%. Then we change the rate to the financed rate and we insert the second Lease Event for the buydown and put “U” for Unknown and then Calculate. The negative Lease Amount is the effective buydown amount.

Here are some tips for structuring a lease interest rate buydown:

- Consider the current market interest rates and your budget when determining the desired interest rate reduction.

- Calculate the cost of the buydown to ensure that it is doable.

- Decide who will pay for the buydown and negotiate the terms of the buydown agreement with the other party.

- Understand the lease should go full term to get the benefit of the buydown.

If you have any questions using TValue software, please give our Support Team a call at 800-426-4741 or email us at support@TimeValue.com.